N.E.R.F.

February 09, 2019

Over the years I've had the privilege of advising and mentoring early stage startup founders along their own entrepreneurship journeys. Often times these interactions tend to start with a problem statement along the lines of:

How do I go about to find investors for my idea?

To answer that question, it's necessary to first understand what is the business that you're building and how will you show proof of success each step along the way. Leveraging the learning from my own mentors and advisors, I've developed a framework that I call N.E.R.F. to help founders distill their thoughts and articulate how they'll go about to execute their business plans to potential investors.

(N)irvana

What is the ultimate vision for your business? Or, as my friend Andy Raskin puts it, you need to pitch the Promised Land. As Andy describes it, there are 3 critical elements in making a vision compelling:

- It should be desirable.

- The realization of the vision is improbable without you.

- You have the secrete sauce of reach the vision.

(E)vidence

What sort of traction do you have for the business? The best traction is sales. In lieu of that, do you have social proof where people are using your prototypes and/or promoting what you're building? Would key opinion leaders (KOLs) in your space testify to the need that your solution is fulfilling?

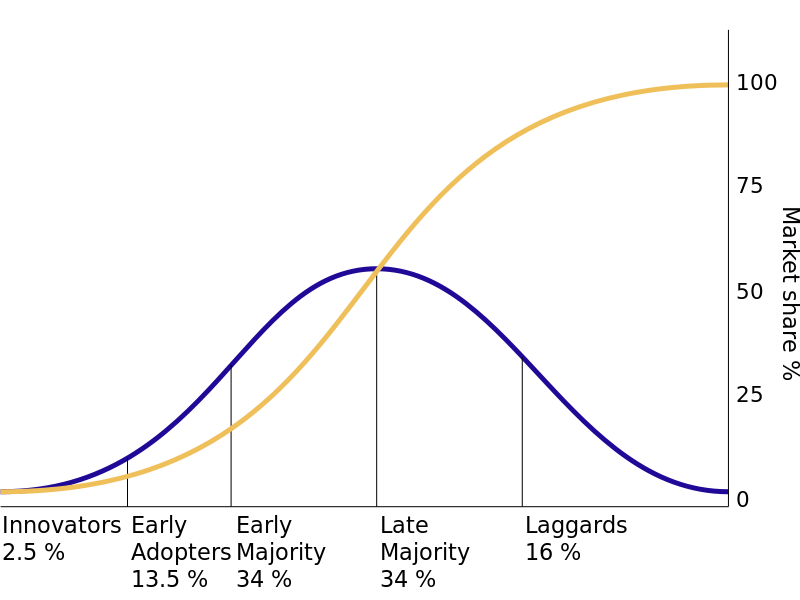

For early traction, be sure to focus on people that have the propensity to try out new ideas and technologies. For those familiar with Everett M. Roger's Diffusion of Innovation theory, these are the Innovators and Early Adopters that make up 16% of your market. Don't waste your energy trying to sell to people who are in the remaining 84% of the market.

Source: Wikipedia Diffusion of Innovation

(R)isks

It's important to understand the risk your business possesses and know exactly how you'll de-risk each risk.

For non-science, non-regulated business, founders are faced with Market and Execution risks:

Market - are there enough buyers for your product?

Execution - can you build an offering to attract those buyers?

Depending on the type of product you're building, your business may have additional risks:

Scientific / Technology - does your product work the way you say it does?

Regulatory - will regulator allow you to sell your product?

(F)inancing

Lastly, how will you get the funding you need to get your business off the ground?

- Friends, family, & angel investors - AKA “believe capital”. These are the people that believe in YOU and are willing to put money to support you.

- Grants & joint-development dollars - Are there innovation grants from the government or private foundations that you can tap into? (For example, there is SBIR in the US and UKRI in the UK)

- Venture capital (VC) - If your product offering serves a large market and has the potential to generate an outsized returns for investors, VC could be an option for you. I highly recommend reading Venture Deals to better understand how venture deals come together.

As a founder, it's easy to focus our attention on pitching the vision to whoever that might invest. However, it's the execution that turns an idea into a fundable business. A compelling vision (Nirvana) that is well executed will generate the traction (Evidence) necessary to de-Risk your startup and attract the investments (Financing) to continue the cycle of executing, de-risking, fundraising until that improbable future is today's reality.